Conoce nuestros productos

Lámpara de mesa Hagano

Lámpara de mesa Crista

Lámpara de mesa Fabricius

Lámpara de mesa Everard

Lámpara de mesa Navier

Lámpara de mesa Adler

Lámpara de mesa Loredo

Lámpara de mesa Drustan

Lámpara de mesa Ariel

Lámpara de mesa Montauk

Lámpara de mesa Havana

Lámpara de mesa Lágrima

Lámpara de mesa Esmeralda

Lámpara de mesa Telestar

Lámpara de mesa Almanzora

Lámpara de mesa Niah

Lámpara de mesa Anastasia

Lámpara de mesa Zesiro

Lámpara de Techo Alenya

Lámpara de techo Tamworth

Lámpara de techo Santina

Sofá modelo Soho

Seccional modelo Wit

Silla modelo Pia

Silla modelo Giacomo

Banqueta de bar modelo Asia

Banqueta de bar Modelo Greta

Butaca modelo Akari

Butaca modelo Bora

Butaca modelo Grad

Butaca modelo Praga

Butaca modelo Roxy

Butaca modelo Sabila

Mesa central modelo Brit

Mesa central modelo Dune

Mesa central modelo Kenia

Mesa de comedor modelo Flow

Seccional modelo Francine

Seccional modelo Sidney

Mesa central modelo Kini

Mesa central modelo Laurent

Mesa de centro modelo Oriol

Mesa central modelo Porto rectangular

Mesa de centro modelo Porto circular

Mesa de centro modelo Sun

Mesa de comedor modelo Duncac

Mesa de comedor modelo Jass

Mesa de comedor modelo Lauria

Mesa de comedor modelo Marutti

Mesa de comedor modelo Provence

Mesa lateral modelo Aron

Mesa lateral modelo Almeria

Butaca modelo Gamila

Butaca modelo Kayla

Mesa de centro modelo Moong

Mesa de comedor modelo Kosmo

Mesa auxiliar modelo Ankara Alta

Mesa auxiliar modelo Ankara Baja

Mesa lateral modelo Borghese

Mesa lateral modelo Cadiz

Mesa lateral modelo Cala

Mesa lateral modelo Cobre

Mesa lateral modelo Dorada

Mesa lateral modelo Legend

Mesa lateral modelo Podium

Mesa lateral modelo Portofino

Mesa lateral modelo Tower alta

Mesa lateral modelo Tower baja

Mesa lateral modelo Veneto

Mesa de centro modelo Kolt

Mesa auxiliar modelo Nido Exit

Sofá modelo Piano 3C

Sofá modelo Piano 2C

Seccional modelo Zoe

Silla modelo Berit

Silla modelo Calipso

Silla modelo Cubic

Silla modelo Nelson con brazo

Silla modelo Provence

Silla modelo York

Sofá modelo Aston 2C

Sofá modelo Aston 3C

Sofá modelo Bloom

Sofá modelo Elan

Sofá modelo Montis

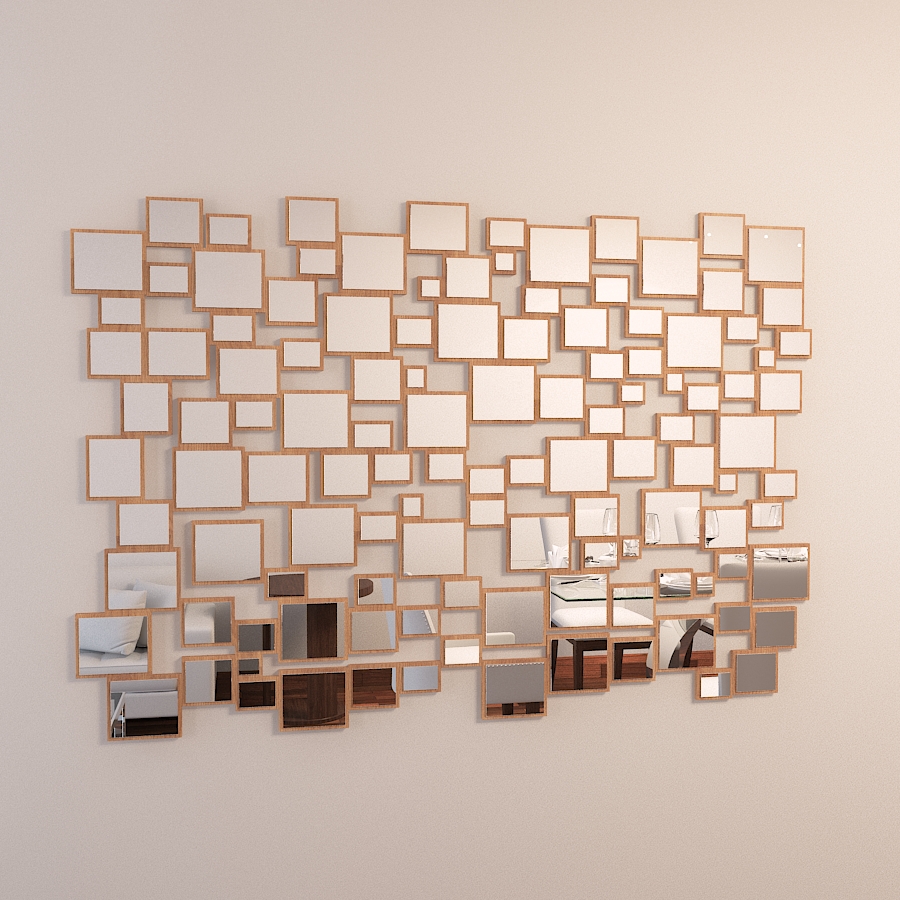

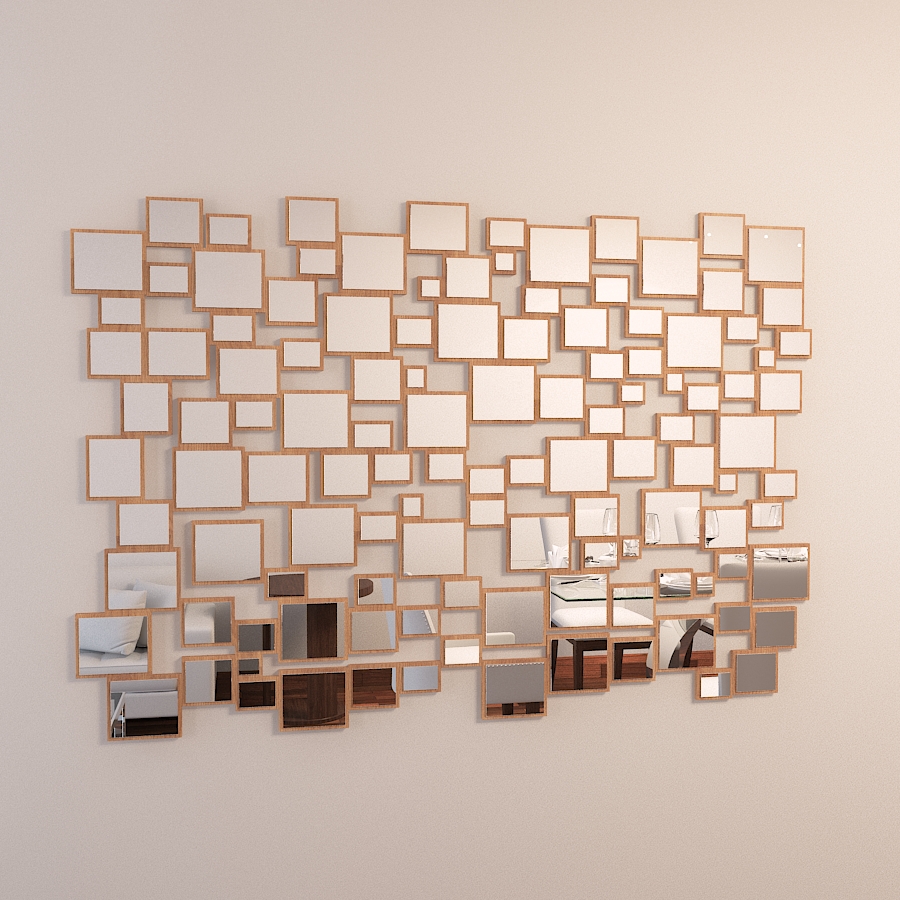

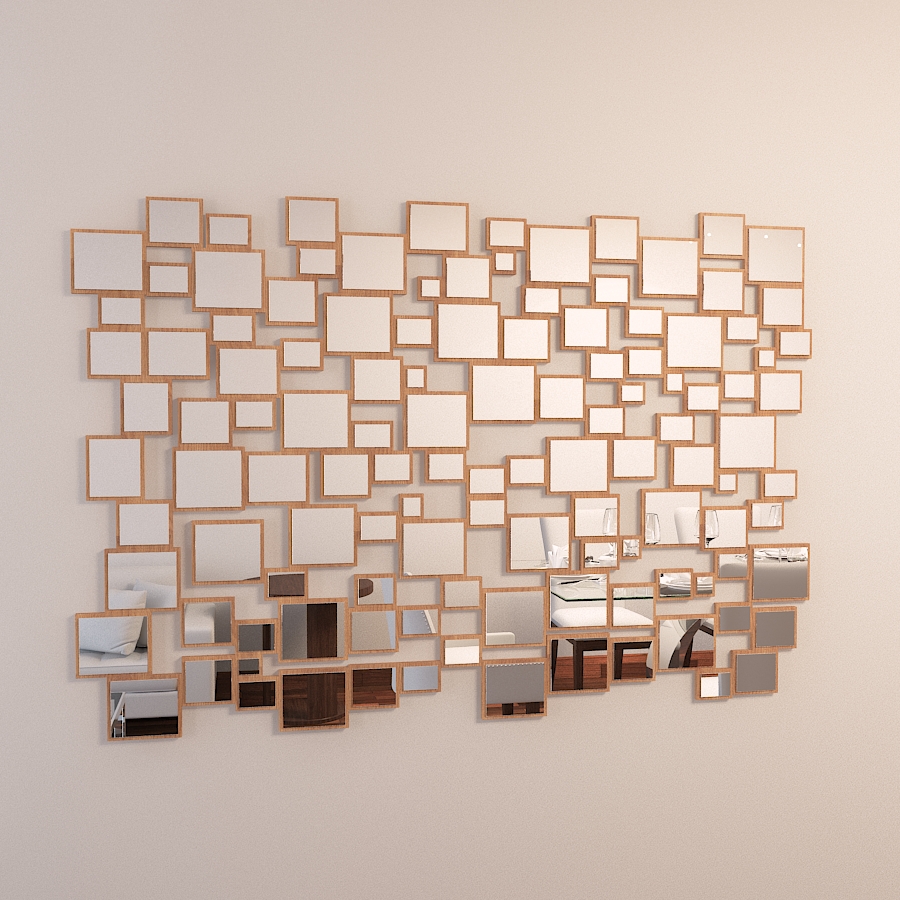

Espejo modelo Ireneus

Espejo modelo Naevius

Espejo modelo Villata

Espejo modelo Zane

Espejo modelo Illyria

Cuadro modelo Foliage

Espejo modelo Sigorney

Reloj modelo Warehouse

Espejo modelo Chaney

Espejo modelo Odalis

Adorno modelo Maxton

Adorno modelo Boaz

Espejo modelo Sinatra

Espejo modelo Maeona

Espejo modelo Tondela

Espejo modelo Mossley

Espejo modelo Haya

Adorno modelo Caballo Dorado

Espejo modelo Porcius

Espejo modelo Amparo

Reloj modelo Auguste

Espejo modelo Valenton

Espejo modelo Chamberlain

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

Mesa central modelo Brit

Mesa central modelo Dune

Mesa central modelo Kenia

Mesa central modelo Kini

Mesa central modelo Laurent

Mesa de centro modelo Oriol

Mesa central modelo Porto rectangular

Mesa de centro modelo Porto circular

Mesa de centro modelo Sun

Mesa de centro modelo Moong

Mesa de centro modelo Kolt

Mesa lateral modelo Aron

Mesa lateral modelo Almeria

Mesa lateral modelo Borghese

Mesa lateral modelo Cadiz

Mesa lateral modelo Cala

Mesa lateral modelo Cobre

Mesa lateral modelo Dorada

Mesa lateral modelo Legend

Mesa lateral modelo Podium

Mesa lateral modelo Portofino

Mesa lateral modelo Tower alta

Mesa lateral modelo Tower baja

Mesa lateral modelo Veneto

Lámpara de mesa Hagano

Lámpara de mesa Crista

Lámpara de mesa Fabricius

Lámpara de mesa Everard

Lámpara de mesa Navier

Lámpara de mesa Adler

Lámpara de mesa Loredo

Lámpara de mesa Drustan

Lámpara de mesa Ariel

Lámpara de mesa Montauk

Lámpara de mesa Havana

Lámpara de mesa Lágrima

Lámpara de mesa Esmeralda

Lámpara de mesa Telestar

Lámpara de mesa Almanzora

Lámpara de mesa Niah

Lámpara de mesa Anastasia

Lámpara de mesa Zesiro

Cuadro modelo Foliage

Espejo modelo Ireneus

Espejo modelo Naevius

Espejo modelo Villata

Espejo modelo Zane

Espejo modelo Illyria

Espejo modelo Sigorney

Espejo modelo Chaney

Espejo modelo Odalis

Espejo modelo Sinatra

Espejo modelo Maeona

Espejo modelo Tondela

Espejo modelo Mossley

Espejo modelo Haya

Espejo modelo Porcius

Espejo modelo Amparo

Espejo modelo Valenton

Espejo modelo Chamberlain

Lámpara de mesa Hagano

Lámpara de mesa Crista

Lámpara de mesa Fabricius

Lámpara de mesa Everard

Lámpara de mesa Navier

Lámpara de mesa Adler

Lámpara de mesa Loredo

Lámpara de mesa Drustan

Lámpara de mesa Ariel

Lámpara de mesa Montauk

Lámpara de mesa Havana

Lámpara de mesa Lágrima

Lámpara de mesa Esmeralda

Lámpara de mesa Telestar

Lámpara de mesa Almanzora

Lámpara de mesa Niah

Lámpara de mesa Anastasia

Lámpara de mesa Zesiro

Lámpara de Techo Alenya

Lámpara de techo Tamworth

Lámpara de techo Santina

Sofá modelo Soho

Seccional modelo Wit

Silla modelo Pia

Silla modelo Giacomo

Banqueta de bar modelo Asia

Banqueta de bar Modelo Greta

Butaca modelo Akari

Butaca modelo Bora

Butaca modelo Grad

Butaca modelo Praga

Butaca modelo Roxy

Butaca modelo Sabila

Mesa central modelo Brit

Mesa central modelo Dune

Mesa central modelo Kenia

Mesa de comedor modelo Flow

Seccional modelo Francine

Seccional modelo Sidney

Mesa central modelo Kini

Mesa central modelo Laurent

Mesa de centro modelo Oriol

Mesa central modelo Porto rectangular

Mesa de centro modelo Porto circular

Mesa de centro modelo Sun

Mesa de comedor modelo Duncac

Mesa de comedor modelo Jass

Mesa de comedor modelo Lauria

Mesa de comedor modelo Marutti

Mesa de comedor modelo Provence

Mesa lateral modelo Aron

Mesa lateral modelo Almeria

Butaca modelo Gamila

Butaca modelo Kayla

Mesa de centro modelo Moong

Mesa de comedor modelo Kosmo

Mesa auxiliar modelo Ankara Alta

Mesa auxiliar modelo Ankara Baja

Mesa lateral modelo Borghese

Mesa lateral modelo Cadiz

Mesa lateral modelo Cala

Mesa lateral modelo Cobre

Mesa lateral modelo Dorada

Mesa lateral modelo Legend

Mesa lateral modelo Podium

Mesa lateral modelo Portofino

Mesa lateral modelo Tower alta

Mesa lateral modelo Tower baja

Mesa lateral modelo Veneto

Mesa de centro modelo Kolt

Mesa auxiliar modelo Nido Exit

Sofá modelo Piano 3C

Sofá modelo Piano 2C

Seccional modelo Zoe

Silla modelo Berit

Silla modelo Calipso

Silla modelo Cubic

Silla modelo Nelson con brazo

Silla modelo Provence

Silla modelo York

Sofá modelo Aston 2C

Sofá modelo Aston 3C

Sofá modelo Bloom

Sofá modelo Elan

Sofá modelo Montis

Espejo modelo Ireneus

Espejo modelo Naevius

Espejo modelo Villata

Espejo modelo Zane

Espejo modelo Illyria

Cuadro modelo Foliage

Espejo modelo Sigorney

Reloj modelo Warehouse

Espejo modelo Chaney

Espejo modelo Odalis

Adorno modelo Maxton

Adorno modelo Boaz

Espejo modelo Sinatra

Espejo modelo Maeona

Espejo modelo Tondela

Espejo modelo Mossley

Espejo modelo Haya

Adorno modelo Caballo Dorado

Espejo modelo Porcius

Espejo modelo Amparo

Reloj modelo Auguste

Espejo modelo Valenton

Espejo modelo Chamberlain

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

COJÍN

El espacio que combina con tu estilo de vida

El placer de vivir con estilo buen gusto y Diseños únicos

El espacio que combina con tu estilo de vida

El placer de vivir con estilo buen gusto y Diseños únicos

El espacio que combina con tu estilo de vida

El placer de vivir con estilo buen gusto y Diseños únicos